Editor’s Note: With VERDAZO proudly joining Omnira Software in 2022, this blog is being re-published on the Omnira Software website.

As producers position themselves to survive a market of low oil and gas prices, most of our clients are targeting downtime in an effort to get the most out of their producing assets. One way we help them do this is by setting up “diagnostic measures” like Lost Production.

Most people have heard of the concept of Lost Production … some have likely debated different terms for it. The important thing is not to get stuck too deep in the details and leverage the insights it affords you.

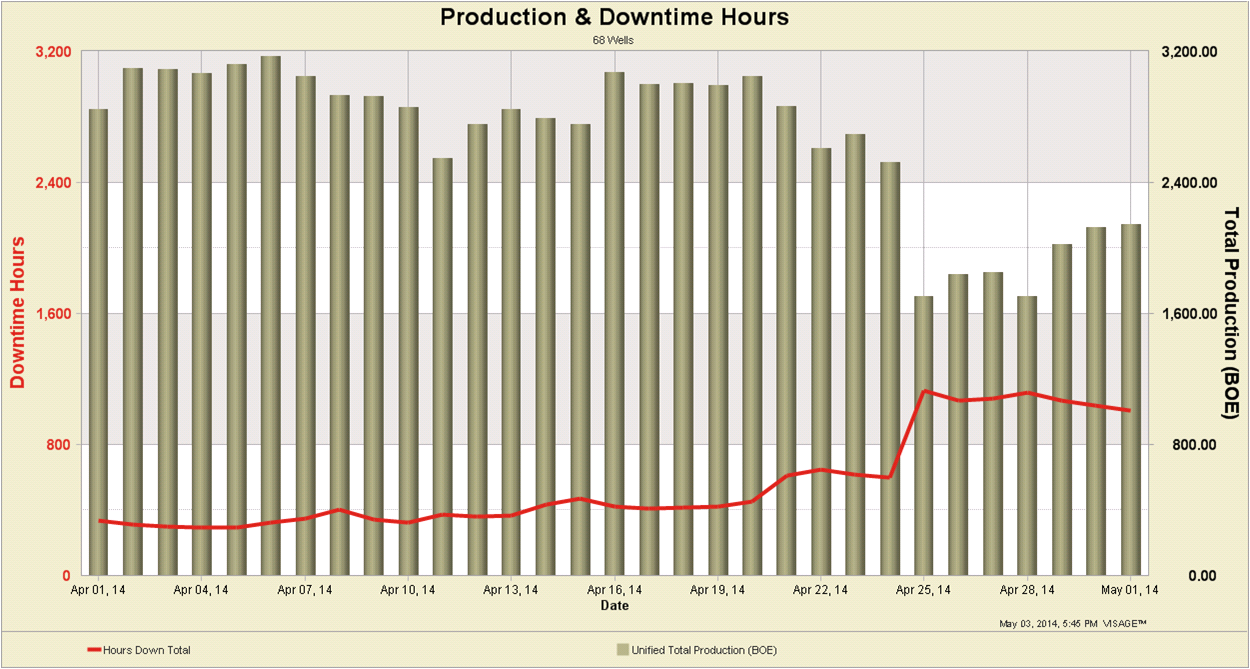

Without the concept of Lost Production producers might only be seeing a chart like this, showing only production rates and hours down. This does not quantify the impact of downtime nor does it explain the nature of the downtime involved.

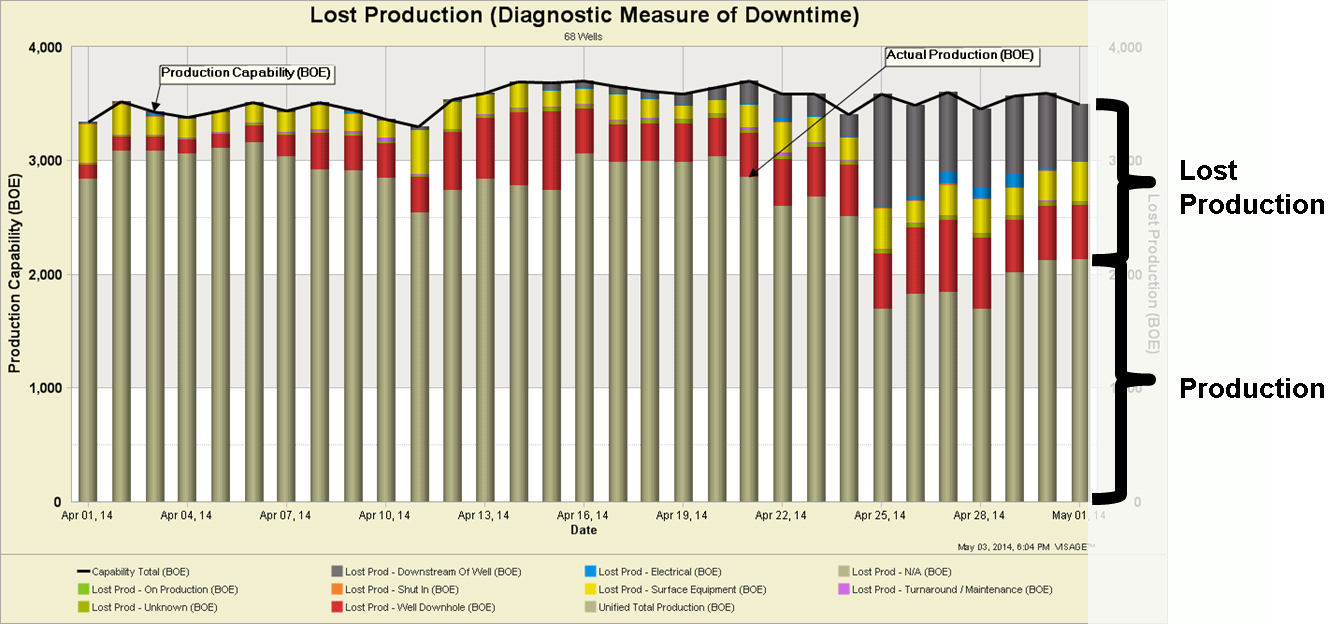

By introducing the concept of Lost Production, you can quantify the production loss that is attributable to downtime, and understand what types of downtime are involved. This next chart shows the different downtimes responsible for the Lost Production of the same collection of wells.

I won’t get into the detailed calculations in today’s blog, but I will provide some guidelines and recommendations on how best to approach Lost Production calculations.

Lost Production Definition

Lost Production = the quantifiable impact of downtime on production

Lost Production calculations rely on a reasonable measure of a wells “capability”. Lost Production is the difference between a wells actual production and the “capability” on days where there are less than 24 hours on production.

Capability

Capability = the production rate you would expect to see on a particular date if the well was producing 24 hours

If you don’t like the name “Capability” choose a different name like “Expected Production Rate”… don’t get stuck on the terminology.

Some important considerations for Capability include:

1) the calculated Capability should be reflective of the most recent representative production rates (e.g. last 7 days of production values where hours on production was greater than 20 hours)

2) Capability is not a measure of the reservoir’s production potential … just an expectation based on recent production conditions

3) Capability is calculated for each day when hours on production is less than 24 hours.

4) Capability should not be derived from too large a time frame (e.g. 3 months) then your expected production rate could be inflated on wells with steep declines.

Recommendation: It’s better to be Vaguely Correct than Precisely Wrong

- This is about coming up with a reasonable diagnostic insight, not a precise measure of Capability and Lost Production.

- Keep it simple and try to minimize the complexity of your calculations whenever possible.

Some complexities you may need to consider:

- You may need to have different approaches for estimating Capability of different well types (e.g. oil wells, gas wells, horizontal wells, intermittent low productivity wells etc.)

- Consider ignoring Lost Production calculations on the first few months of a well’s life. The declines are steep and you’re still figuring out the well.

- Consider when to stop calculating Lost Production (i.e. identifying when a well is finished producing, or uneconomic)

- Consider if certain downtime codes/reasons should be excluded from Lost Production calculations

In the New Year I’ll start off a new blog series and show you how to use Lost Production in a “diagnostic workflow”.

Thanks for reading. I welcome your questions and suggestions for future blogs.

About Bertrand Groulx

Bertrand Groulx is a well-respected oil and gas industry expert with almost 30 years of experience driving innovation and developing advanced solutions. He possesses deep knowledge and understanding of data analytics in the sector, which has allowed him to deliver unparalleled enhancements to Omnira Software's VERDAZO and MOSAIC software products. Bertrand's extensive accomplishments in the public and private sectors and his scientific publications and presentations on machine learning, visual analytics, and completion optimization have made him a thought leader. With a B.S. Honors in Geology and Geology and Geomorphology from the University of British Columbia, Bertrand focuses on enhancing Omnira Software's business intelligence and discovery analytics products in his current role, particularly the VERDAZO platform's growth and development. As a blog author, Bertrand shares his unique expertise and insights, offering valuable knowledge and guidance to industry professionals seeking to stay at the forefront of the constantly evolving oil and gas landscape.