Editor’s Note: With VERDAZO proudly joining Omnira Software in 2022, this blog is being re-published on the Omnira Software website.

Guest Blog by: Tyler Schlosser, P.Eng., Director of Commodities Research, GLJ Petroleum Consultants This is the next installment in a blog series on commodity pricing and how VERDAZO is used to analyze pricing data when building GLJ forecasts…

Understanding Trends in Gas Futures with Just Two VERDAZO Charts

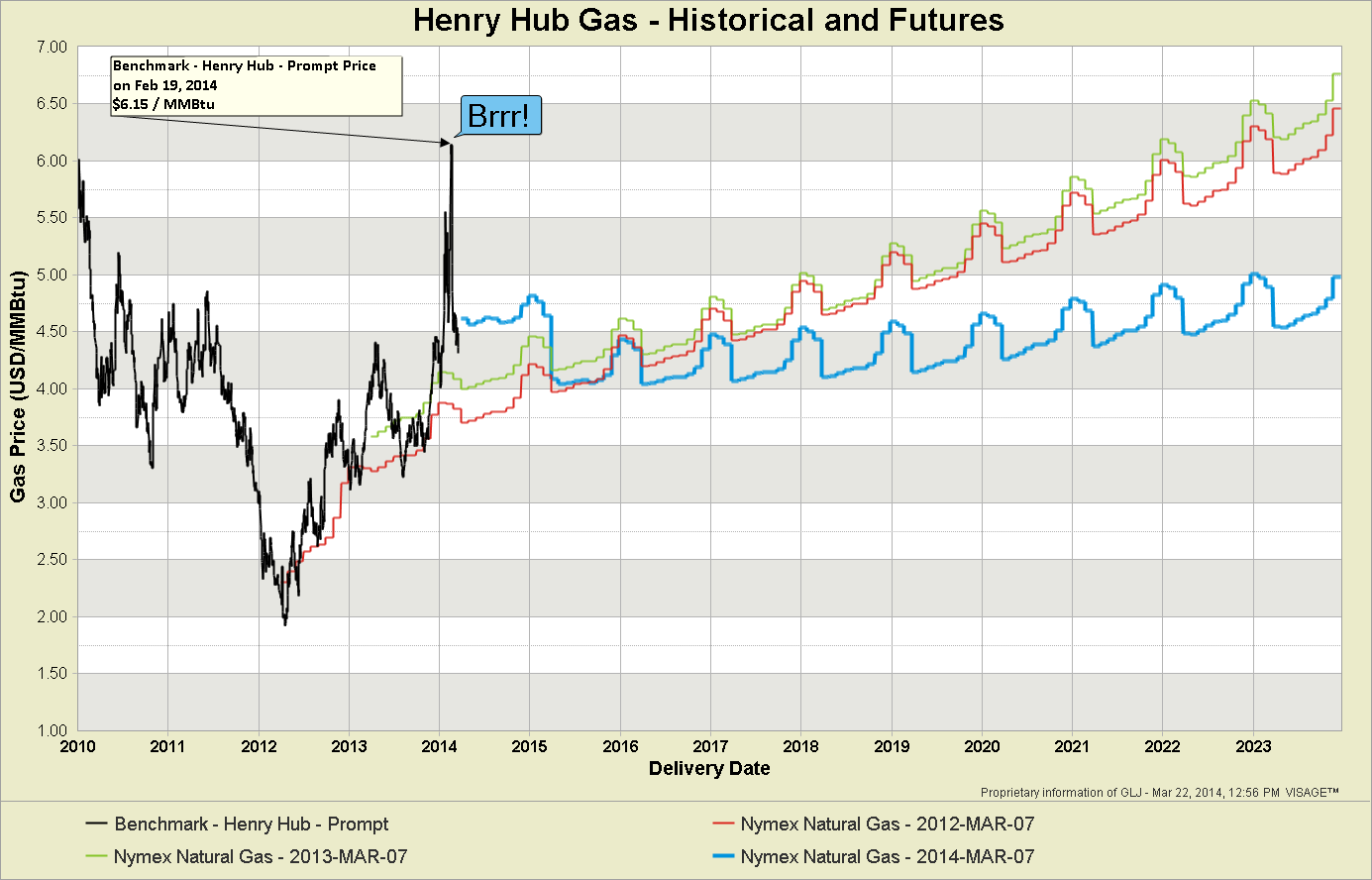

Anyone who follows energy markets could tell you that natural gas prices in North America spiked this winter. Prompt month prices** for the most widely known North American benchmark, Henry Hub, are down from their weather-driven peak, but are still priced considerably higher than 2013 expectations.

**Prompt Month Price definition: refers to the futures contract that is closest to expiration and is usually for delivery in the next calendar month (e.g. prompt month contracts traded in February are typically for delivery in March)

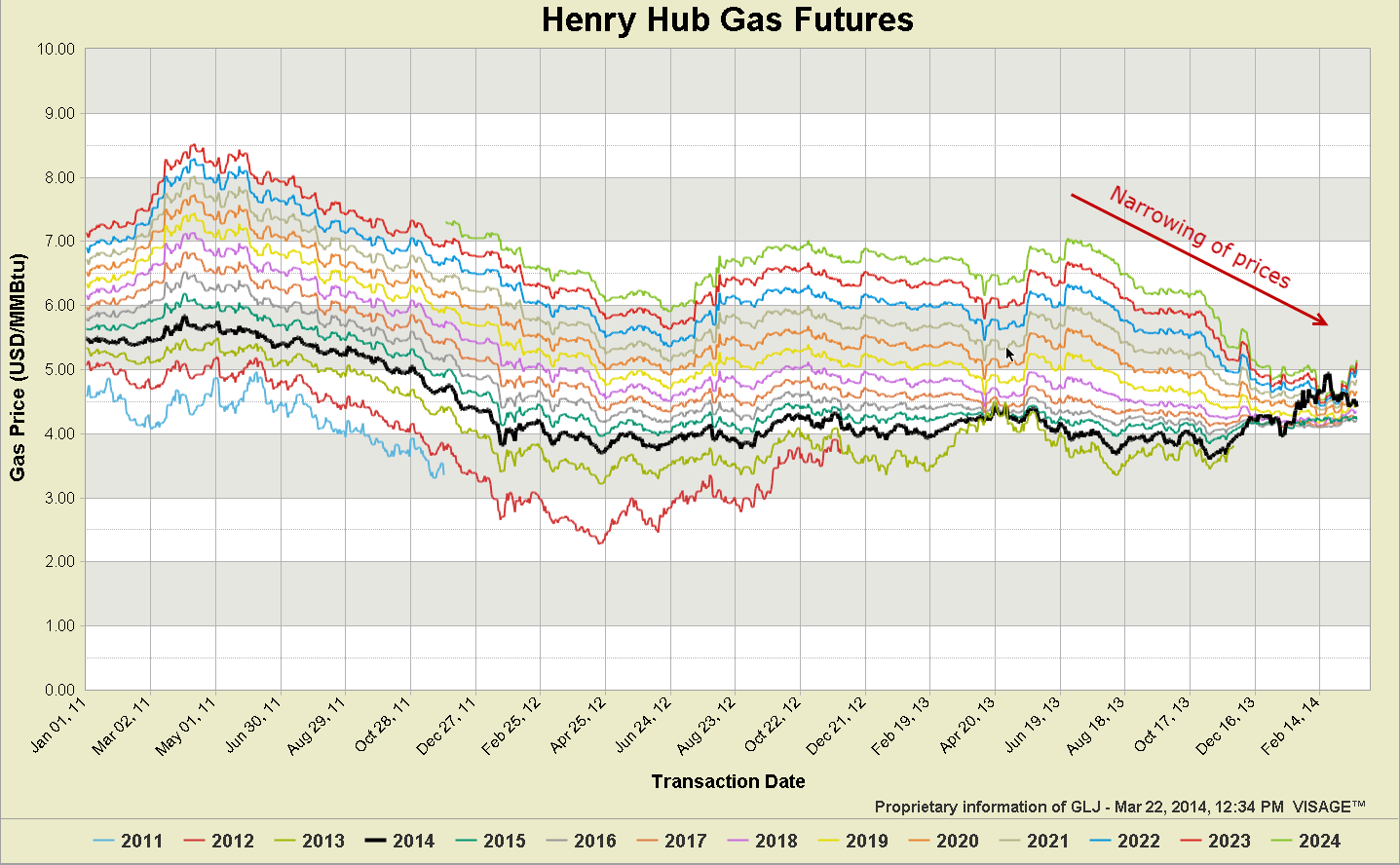

With North American storage levels now much lower than they have been in recent years, is this the beginning of a new sustained bull market for natural gas? It looks like prices are sure to be higher for the remainder of 2014, but what about 2015 and beyond? What contract prices have producers, consumers and speculators been willing to accept – what does the market think? In VERDAZO, we can quickly see a snapshot of market prices for Henry Hub gas futures contracts from both the transaction date perspective (the date a contract agreement occurs) and the delivery date perspective (the future date for which gas delivery is specified by the contract). Here’s a chart of Henry Hub gas prices where each curve represents a delivery year, with the transaction date on the horizontal axis.

This chart immediately shows us a few things:

- Prices for gas delivered in 2014 (the black curve) have gone up significantly in the past few months

- The market sees the recent price spike as a temporary phenomenon, as evidenced by the fact that while 2014 prices have increased over the last 6 months, prices in subsequent delivery years have not

- The spread between prices for gas delivered in the near future and prices for gas delivered several years from now has narrowed dramatically

- Recent narrowing of price curves (from Oct 2013 transaction dates to present) has occurred primarily through falling prices for gas delivered in the more distant future

Now, for another perspective. Below is a chart of Henry Hub prompt month gas prices (in black), along with three forward curves. Each curve represents a single transaction date, with the delivery date on the horizontal axis. The blue curve represents closing prices from the March 7, 2014 contracts, with the green and red curves representing contracts from one and two years earlier, respectively.

Some quick observations from this chart:

- Weather affects gas prices

- Prices for gas delivered in 2014 have risen over the past two years (see how the blue line is much higher than the red and green lines for 2014 delivery dates)

- Prices for gas delivered in spring to winter 2015 are relatively unchanged over the past two years

- Prices for gas delivered in 2016 are lower than they were last year, and prices for gas delivered beyond 2016 have fallen even more relative to last year

- Prices have been escalating with delivery date in recent years (red and green lines), but are now quite flat across the delivery date range (blue line)

Future commodity prices are very difficult to predict, and it is an oversimplification to say that futures prices are simply a forecast of spot prices*** in the future. However, understanding the prices at which real money is exchanged for real commodities on open, transparent markets is essential when anticipating what may happen in the future.

*** Spot Price definition: the explicit value of a commodity at a given time in the marketplace